2009 Tax Law Highlights

Tax Credit of Up to $8,000 for First-time Home Buyers.

If you purchased a primary residence in 2009 before December 1, 2009 and are a “first-time” home buyer, you can qualify for a tax credit. The credit is equal to 10% of up to $80,000 of the purchase price.

Eligibility:

- You must not have owned a residence in the U.S. in the previous three years.

- The credit phases out between $150,000 and $170,000 of adjusted gross income for joint filers $75,000 to $95,000 for single filers.

- The credit is refundable to the extent it exceeds your regular tax liability — which means that if it more than offsets your tax liability, you’ll get a refund check — but it does not offset the alternative minimum tax.

- You can elect to claim the credit for a 2009 home purchase on your 2008 tax return. (If you filed for 2008 before buying — but before the November 30 deadline – you can claim your credit by filing an amended return using Form 1040-X. Doing so will guarantee you a refund check.)

- Unlike the credit for 2008 purchases, the credit for 2009 purchases doesn’t have to be paid back ratably over 15 years. But you will have to repay the credit if you sell the house within three years of the date you bought it.

Payroll Tax Credit.

For 2009 Congress gave workers a credit of 6.2% of their earned income:

Capped at $400 for single filers and starts phasing out at $75,000 of adjusted gross income and stops at $95,000.

$800 for joint filers. The phaseout zone for couples is $150,000 to $190,000.

Employees will get the credit in advance via lower income tax withholding in each paycheck, not as a rebate check.

Self-employed workers can reduce their quarterly estimated payments to get an advance benefit from the credit. The exact amount of the payroll tax credit for the year will be calculated on the filers’ tax returns.

Recipients of Social Security benefits, Railroad Retirement benefits, and Supplemental Security Income or veterans disability pensions will get a one time $250 check instead for 2009. Federal retirees who don’t receive any Social Security will also get a $250 check.

Sales Tax Deduction for New Vehicles.

Buyers of new vehicles can deduct the sales tax paid on the purchase, even if they don’t claim sales taxes as itemized deductions. They can add the tax they pay to their standard deduction. This break applies to vehicles purchased after February 16, 2009 and before January 1, 2010. Sales tax paid on the first $49,500 of cost qualifies. The benefit begins phasing out for married couples with AGIs over $250,000 and singles with adjusted gross incomes over $125,000, and is completely gone for single filers with adjusted gross income of $135,000 or more or joint filers with AGI of at least $260,000.

Itemizers who elect to deduct state sales taxes in lieu of state income taxes get no benefit from this change because the auto sales tax is already included in the sales tax deduction. Itemizers who deduct state income taxes will get a separate deduction for auto sales taxes; non-itemizers will add the sales tax amount to their standard deduction amount.

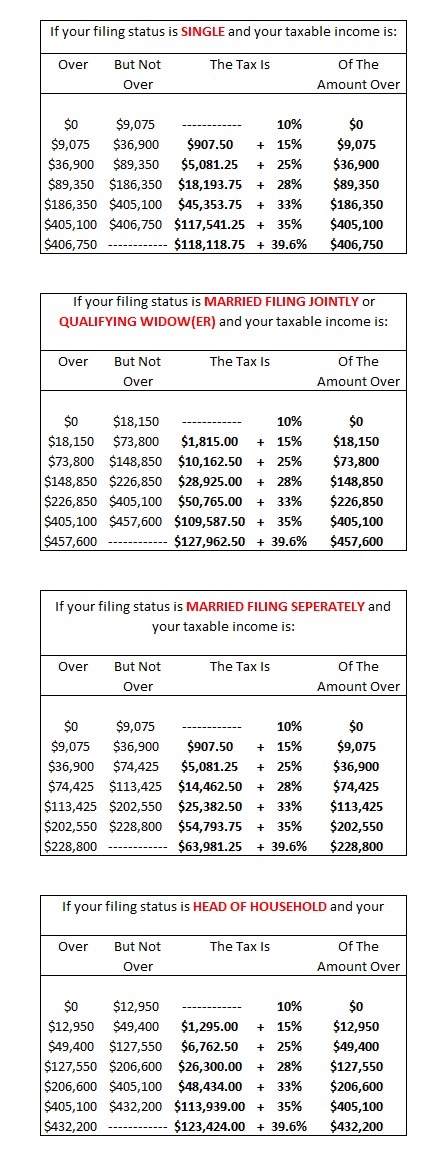

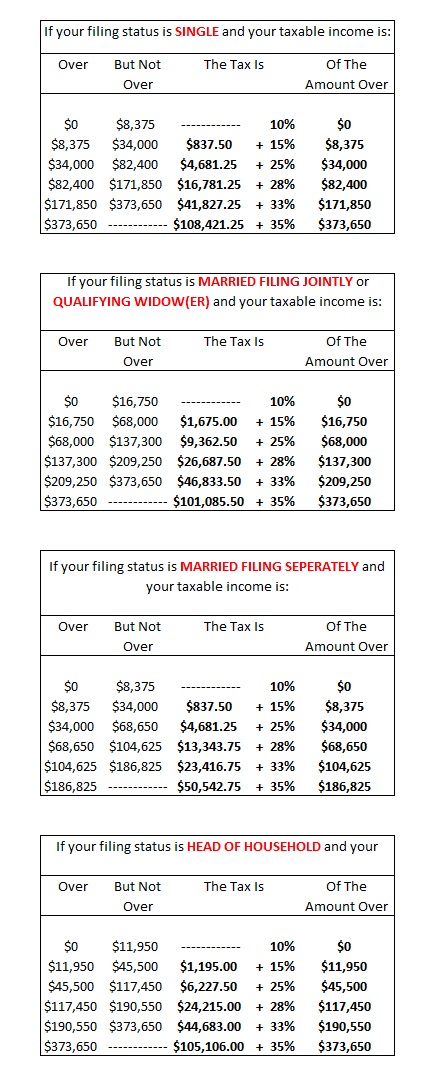

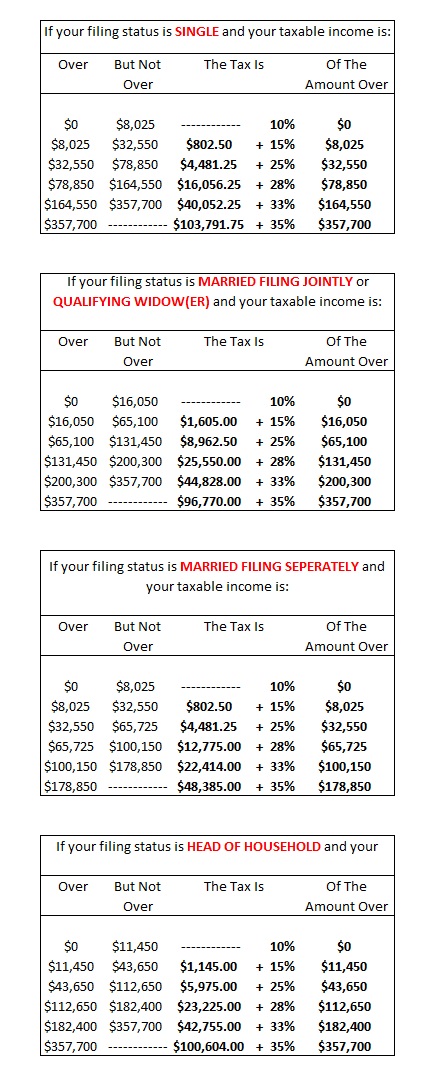

Indexed Tax Brackets. Thanks to higher inflation in the past year, the 10%, 15%, 25%, 28%, 33% and 35% tax brackets all kick in at approximately 5% higher levels of income than in 2008.

Larger Personal Exemptions. For 2009 each personal exemption you can claim is worth $3,650, up by $150 from 2008.

Higher Standard Deductions. For 2009 the standard deduction for MFJ rises to $11,400, up by $500 from 2008. For single filers, the amount increases to $5,700 in 2009 up by $250 over 2008. And heads of household can claim $8,350 in 2009 a jump of $350 from 2008. Non-itemizers who pay real estate taxes can claim larger standard deductions. Joint filers can add in up to $1,000 of property taxes paid. Singles can add in up to $500 of real estate tax payments. Non-itemizers can also add any casualty losses that occurred in presidentially declared disaster areas.

Reduction in Itemized Deductions and Personal Exemptions for High-Income Taxpayers. The cutback in itemized deductions occurs once your adjusted gross income exceeds $166,800, regardless of your filing status. Your itemized deductions are reduced by 1% of the amount by which your AGI exceeds $166,800, but you can never lose more than 80 percent of your itemized deductions. Also, your medical expenses, investment interest deduction, deductible gambling losses and any casualty and theft losses are not subject to the cut.

Personal exemptions are reduced by 2% for each $2,500 of adjusted gross income over $250,200 for married filing jointly, $208,500 for heads of households and $166,800 for singles,

Tax-free Parking for Employees. Starting in 2009 firms can pay for $230 a month of parking tax free for employees, up $10 per month from 2008. The cap on tax-free transit passes is now $230 a month as well, the same as for parking. The limit had been $115 a month in 2008.

Tax Credit for College Tuition. For 2009 the Hope credit is replaced by a new credit of up to $2,500 per student a year for four years of college. It now also covers the cost of books and begins to phase out at $80,000 of adjusted gross income for single filers and $160,000 for joint filers. If the credit is more than your income tax liability, 40% of it is refundable.

Child Tax Credit. If the credit exceeds the filer’s tax liability, all or part of the credit will be refunded if the filer earns more than $3,000, down from $12,550.

Earned Income Tax Credit. For families with three or more children, the maximum earned income tax credit for 2009 rises by $628.50. The phaseout of the credit for joint filers starts at higher income levels in 2009 allowing more of them to claim the credit.

Higher Income Limits for Deductible IRAs and for Roth IRAs. If you are covered by a retirement plan at work, you can take a full IRA deduction in 2009 if your modified adjusted gross income is less than $89,000 (married filing jointly) or $55,000 (single or head of household).

A partial deduction is allowed until your adjusted gross income reaches $109,000 if you are married filing jointly or $75,000 if you are single or a head of household. Also, the opportunity to contribute to a Roth IRA is now phased out as your modified adjusted gross income rises