When tax time rolls around, you typically have to file a state income tax return at the same time that you file your federal income tax return. However, if you live or work in one of these seven states you will not have to file an income tax return come tax time:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

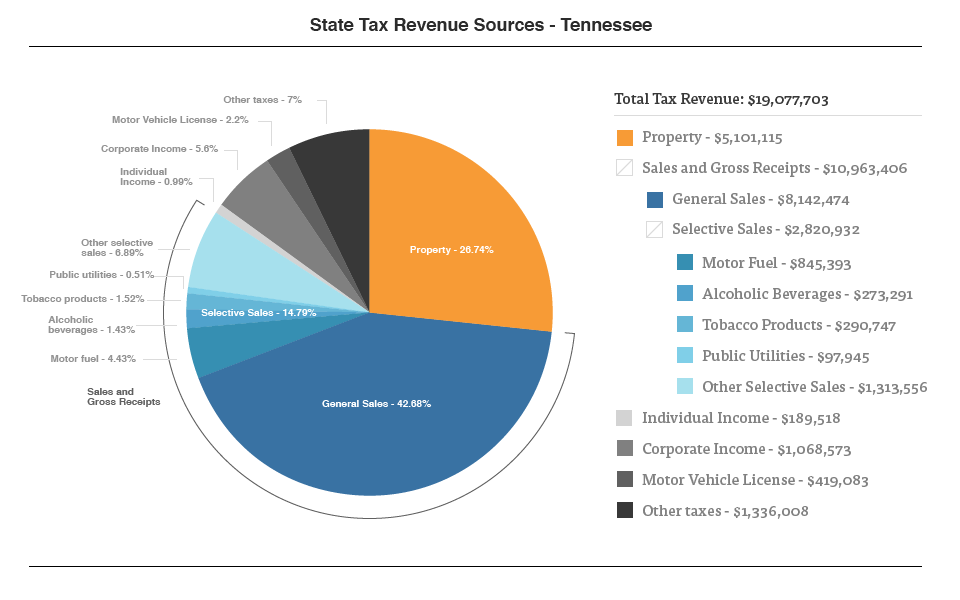

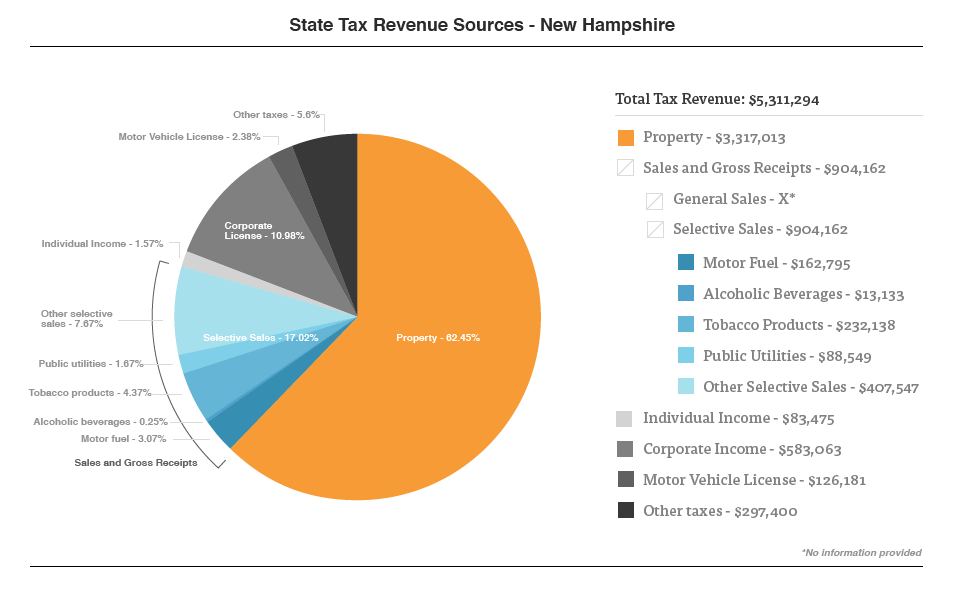

In addition to the above states, the following two only tax income from dividends and interest:

- Tennessee

- New Hampshire

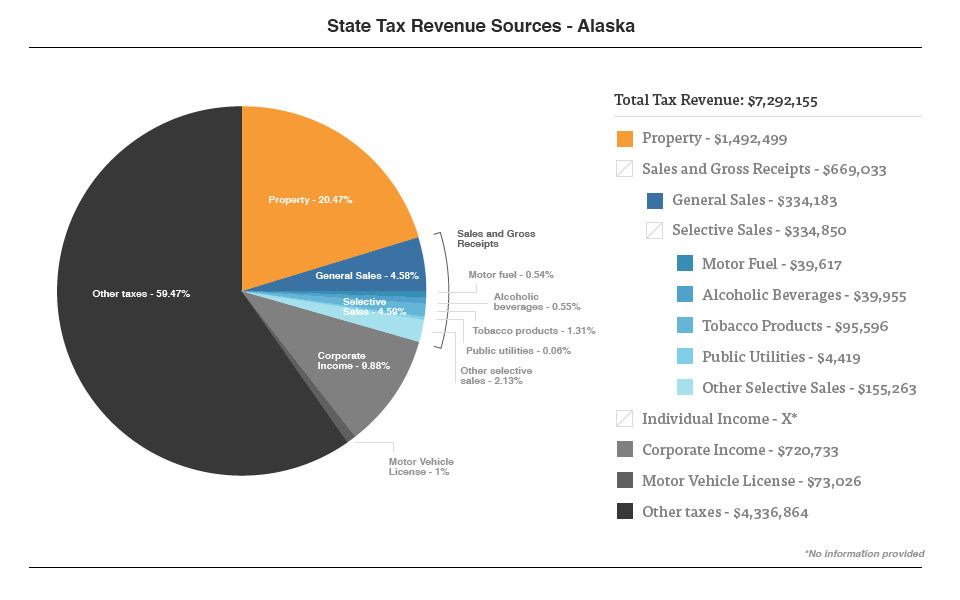

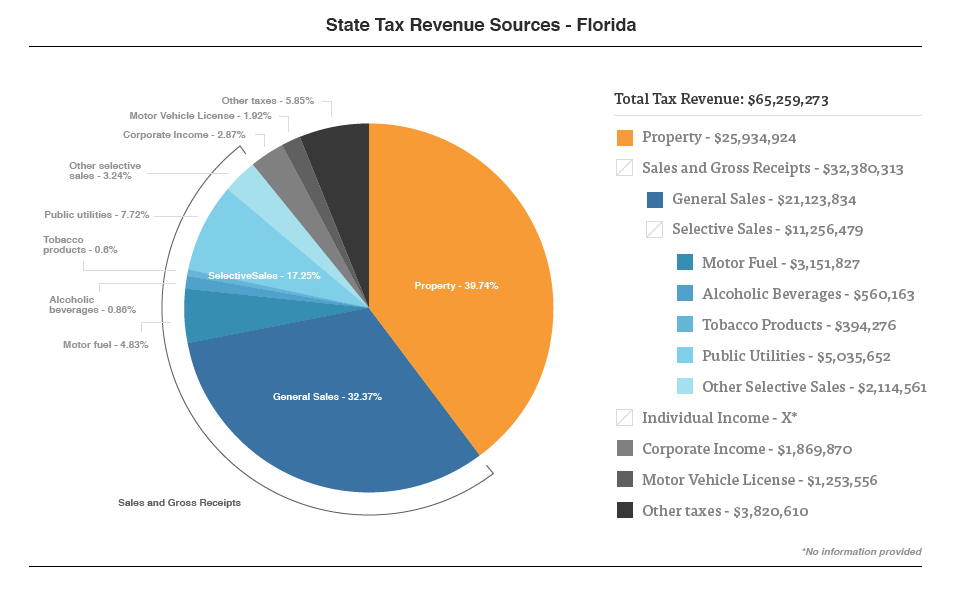

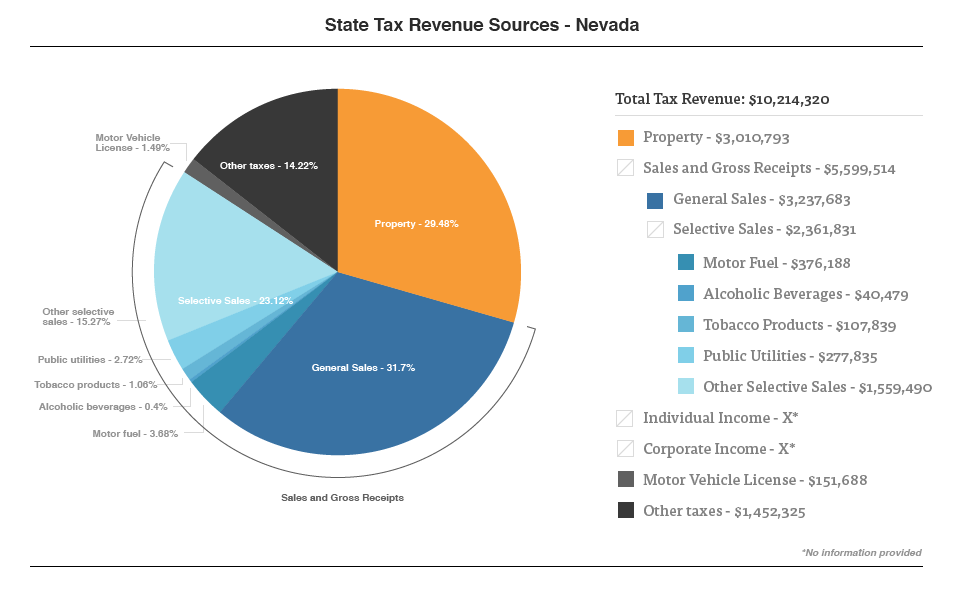

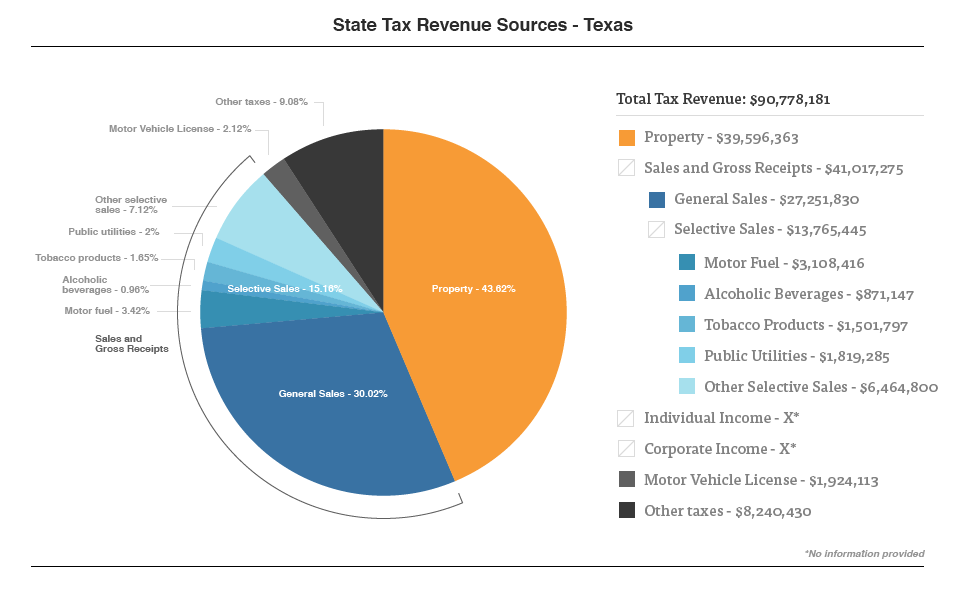

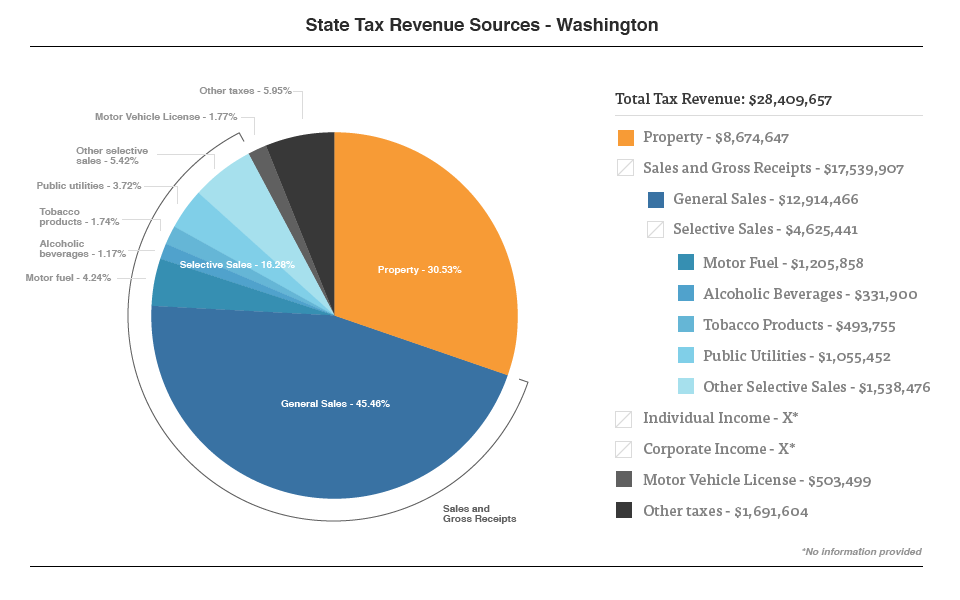

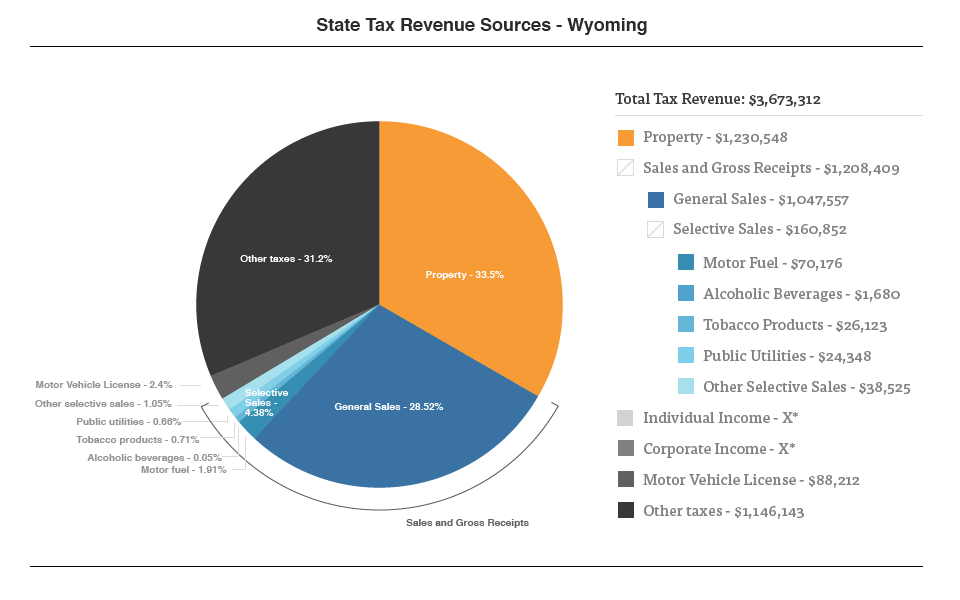

Living in one of these states will certainly save you from the hassle of having to file an extra return during tax season, but it won’t necessarily save you any money. These states make up for the gap left by not collecting income taxes by charging relatively higher property, sales, and fuel taxes. Based on 2013 data, the following graphics indicate where each of these states derived their revenue:

Normally, you have to file a resident tax return in the state where you are a resident. That state will tax you on all of the income earned, no matter what state it is from. Thus things can get a little complicated if you live near the boarder in any of the “non-tax” states but work in one that does charge its residents an income tax.

So if you are a resident of a state without an income tax, you will still need to file a return in any other state where you earned money. Conversely, if you are a resident of a state with an income tax, but you work in one of the seven without one, you will not have to file a nonresident return there.

Remember, you can easily take care of all your state income tax returns at the same time you file your Federal return. Have unfiled state returns that you need to take care of? Feel free to give us a call or shoot us an email.